Like many retirees, I am draining both my savings accounts and my checking accounts. I made the decision to do this when I quit the job I had at the imaging firm. As much as it pains me to see my balances go down, I know that this annoyance will end soon - when Social Security payments kick in.

- - - - - -

Unlike many people, I am lucky to have a pension, a reasonably sized social security payment (as of January), and a 401K which I have only touched once. Managed properly, in an age of low inflation, I am reasonably set for life - as long as I stay tolerably healthy. And I will be trying to stay tolerably healthy for as long as I can do so.

But what does this all mean?

In order to stay healthy, I will need to lose weight and become more active. The older I get, the harder this is to do. There is a benefit to this - I will be able to refresh my wardrobe from more sites that I can now choose from. It'll be much easier to buy nice clothes when I'm a size-22w than now, when I am a size-28w.

- - - - - -

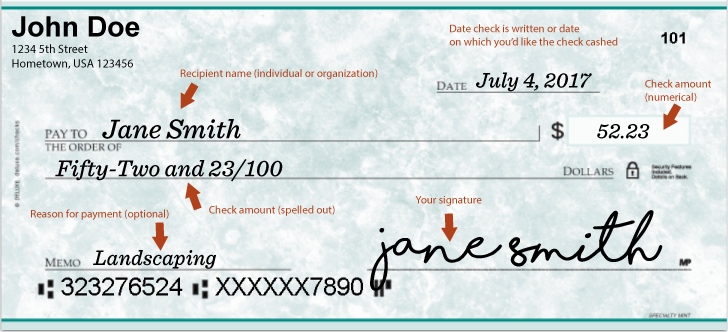

And now, back to checks....

I rarely write checks these days, save for those recipients to whom I don't want to make electronic money transfers. When I was gainfully employed, I worked on machines which would process over 2mm checks per day, items moving through check sorters at 20 mph. Now, if a bank receives a check, it is captured where it is received, and digital copies of the check are electronically exchanged between banks. Check volume is only a small fraction of what it once was, and that is a good thing. Yet, I miss the old way of doing things. It was tactile (in some ways) and physical. Today's method of moving money may be more secure, but it is too easy to lose track of where one's money is going.

Would I switch back to paper checks for most of my bills? No. Even I respect today's reality and accept change for the benefits it provides. But I do miss the days when I was paid very well for a business model which is mostly obsolete now.

No comments:

Post a Comment