The new year came, and I'm glad that 2019 is now behind me. Having lost two of my best friends, I am now forced to rebuild a social network. I no longer have someone I can call at any time of day when I need someone to talk with. This is the great loss I want to put behind me once and for all.

- - - - - -

Last night, I made a hard decision. Do I go to the FTF meetup in New Fairfield? Or, do I go to a special game night in Yonkers? After some hemming and hawing, I chose game night. This was the wise decision. Instead of being in an unfamiliar place where I didn't know anyone that well, I was in a familiar place where I was familiar with everyone. I was closer to my comfort zone, and was able to enjoy myself before driving home around 12:30 or so.

When I got home, I scheduled an email to be sent to GFJ sometime tonight. The gist of the email is an apology and a goodbye. I don't expect to hear from her again, so I'm letting her know that I have disconnected from her as well. It's better that I take the time to process my grief than to dwell in past hopes that never could have been.

- - - - - -

With the emotional maelstrom I've been dealing with for the past 3 months, I was annoyed to receive an angry email from my former cruise partner. Thinking about things, there could be only one reason she sent it - she doesn't know how to stop feeding her anger. After having someone like me to talk with for years, it must hurt to have no one close to confide in. Couple this with me talking more about her than she really wanted me to talk about her in the old blog, and feelings of betrayal must make things hurt even more.

In the past, this woman told me that she was looking for a "Soul Mate". I only looked for a "Life Partner". There are big

differences between soul mate and life partner. Without that "someone" to fill the holes in her life, she will always feel incomplete. Contrast this with GFJ and myself. Both of us felt reasonably complete in ourselves, wanted to share of ourselves, but didn't need each other to be whole in ourselves. Hopefully, my former cruise partner will discover something which helps her feel more whole in her life. If so, she may be able to deal with her anger, let it drain away over time, and maybe find some true love in the process....

- - - - - - - - - - - - - - - - - -

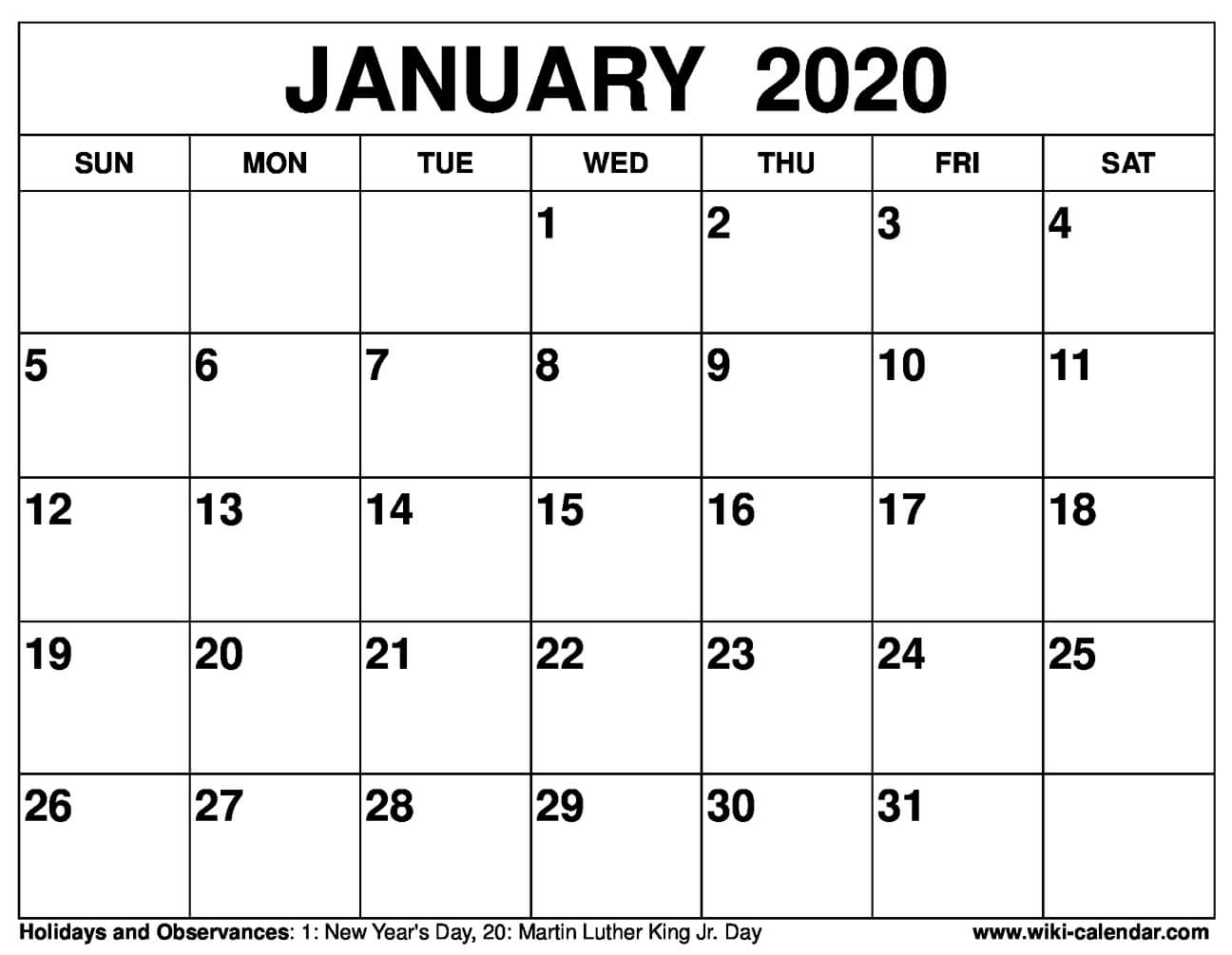

I awoke on New Year's Day with nothing special to do, no one special to see. All my New Year's greetings were exchanged the night before with nothing left over for today. Although I could always drive down to see my dad, did I want to do so for 15-30 minutes worth of a visit? Maybe next weekend. Did I want to go see a movie? Maybe. I'd have to think about it. But to start off my day, I chose to watch my morning TV show and to catch up on my blog reading.

It's gotten to the point where my default presentation for going out in the world is as Marian. Yet, I'm still comfortable going out as Mario. And I'd have stayed that way if GFJ had stayed in the picture. If I'm doing anything requiring heavy activity, that requires me breaking a sweat, that will likely have me presenting as Mario. Unless I looked more authentic as Marian, I wouldn't feel comfortable doing things like going on a hike, cleaning up the kitchen, etc. this way. I'll be stuck living life in both genders for now, unless I go for FFS surgery. And I don't see this happening anytime soon. (First, I'd want to find out about hair transplants to give me a more normal looking head.) It'll be more important for me to develop my social network than to move further along this transition path.

- - - - - -

Politics is still the depressing it was last year. Given how our president's policies have hurt the transgender community, I can only hope that a better person wins on Election Day. Even if I wanted to work for one candidate this year, being with the census bureau will nip that in the bud. The only political action I can participate in is to vote on Election Day. And that's fine with me. So don't expect me to say much here for the next few months, other than how I see issues framed. Direct public support of any candidate will likely be against the rules for employees of the bureau.

Like many of us, I've begun to cringe whenever I hear our president speak. It's hard to watch the news these days, because the underlying tone is much worse than I could have expected 4 years ago. I'm not alone in thinking that 4 more years of this man in power will be a total disaster. When people other than myself are comparing this man's actions to those of a Central European Leader of the 1930's, it is easy to be frightened. I fear the ultimate endpoint if we keep going down his path.

As I'm writing this, none of us know what will happen with the presidential impeachment. It has yet to be delivered to the Senate. I have a strong feeling that it will never be delivered to the upper chamber. Why should Pelosi bother giving Trump a chance to say that he has been exonerated? It's better for her to let him say she's chicken. The longer the impeachment is in stasis, the more likely it is for the House to find and expose evidence that will hurt the GOP in the next election. Unless the Senate trial allows specific witnesses to be called AND has a secret ballot, the conclusion is a forgone conclusion - the Senate would acquit the president. Why should she make the Democrats look like fools for being forced into voting yes on articles of impeachment?

- - - - - -

Later this year, I plan to go to a financial planner for a financial checkup. For the most part, I feel that I am doing reasonably well. Yet, I could have done better had I had my current wisdom when I was young. Neither my niece nor my nephew will do as well as I have done. Neither of them has been able to save any money yet, and it will only get worse when they are in a position to raise children. If there is any advice that should be given to a 20-30 year old person, the advice would be simple - skimp on luxuries and save as much as possible for your future retirement. The formulas show that if a person saves "X" dollars per year between ages 20 and 30 then stops contributions, that person will have more money than if that person started putting away the same "X" dollars per year from ages 30 to 65. Sadly, I can't give my younger self this advice. But I can still advise my niece and nephew to save as much as possible, and explain why to them.

Luckily, I'm in a better position than last year regarding taxes. I'll have paid all the money I expect to owe the government, and I will have lower estimates for this year. However, I don't know how much of an income bump I'll have this year due to the temporary job. Nor do I know what that will force me to pay in estimated taxes one year later. So I plan to save half the after tax money I make from the temporary job and reserve it for taxes.

- - - - - -

Given that I had nothing to do during the day, I decided to rest in bed. I won't have this luxury much longer. But while I do, I'm going to take advantage of it. If I'm in the mood later on, I'll start tearing apart the corners of my room to figure out where I put things AND to find more stuff amidst all the clutter that I can throw out.