I always feel a little sad when RQS goes home. I love having her near me, but I also feel a little freer when I have the time to take care of my own affairs without worrying about her feelings. We have a good thing going, where our periodic absences from each other's lives makes the fondness grow stronger.

Today, RQS had to go home. She had things to take care of at home, and I had things to do here as well. So, after relaxing all day (and having some of our leftover lobster), we got showered and dressed (me in a $5.00 dress I picked up at Burlington a few years ago) and prepared to go to the station. So, around 3:15, we left for the train station, me without my wallet in my handbag. Well, after dropping RQS off, I found out that I left my wallet at home while I was on the drive thru lane at McDonald's. AARGH! You can guess how careful I drove home - I'm glad nothing happened on my way home.

Next, I was off to Walmart with my wallet in hand. It was time for me to replace my car's cell phone charger. When I brought the charger and cable up to the cash register, the credit card reader had problems with my card. Why, I do not know. But I ended up having to swipe the card instead of inserting the card to charge this to my account. Later, I'd find out that my credit card company's fraud detection system had texted me about this transaction, and I okayed it. Luckily, I had a second charge card for another transaction I'd make in the same store.

- - - - - -

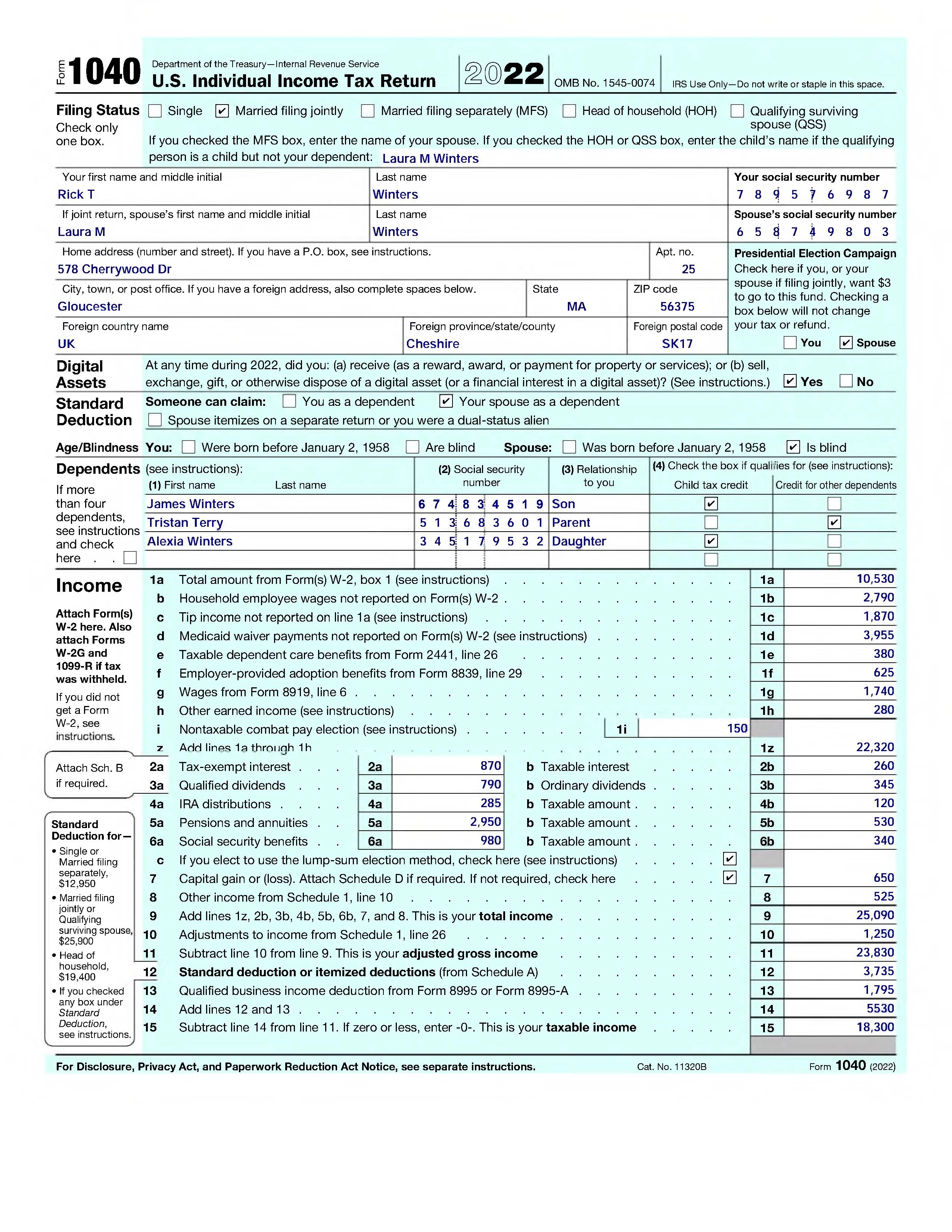

When I got home, I found that RQS had a problem with her taxes. (I won't go into details here.) When our tax lady looked into it, she found that Fran (who RQS used for her taxes 2 years ago) made a mistake, and RQS got flagged for a problem with her 2022 taxes. OUCH! This makes me glad that I had to do a last minute shuffle and find our current tax preparer. I just wonder what tax year 2025 will look for me....

PS: The tax problem was with a previous tax preparer's mistake - The State/Local forms were not filled in correctly. The person who did the taxes did this two years in a row. I'm glad that both of us have someone good on the case these days - I almost got stuck using this person, and dodged a bullet with my taxes.

.png)